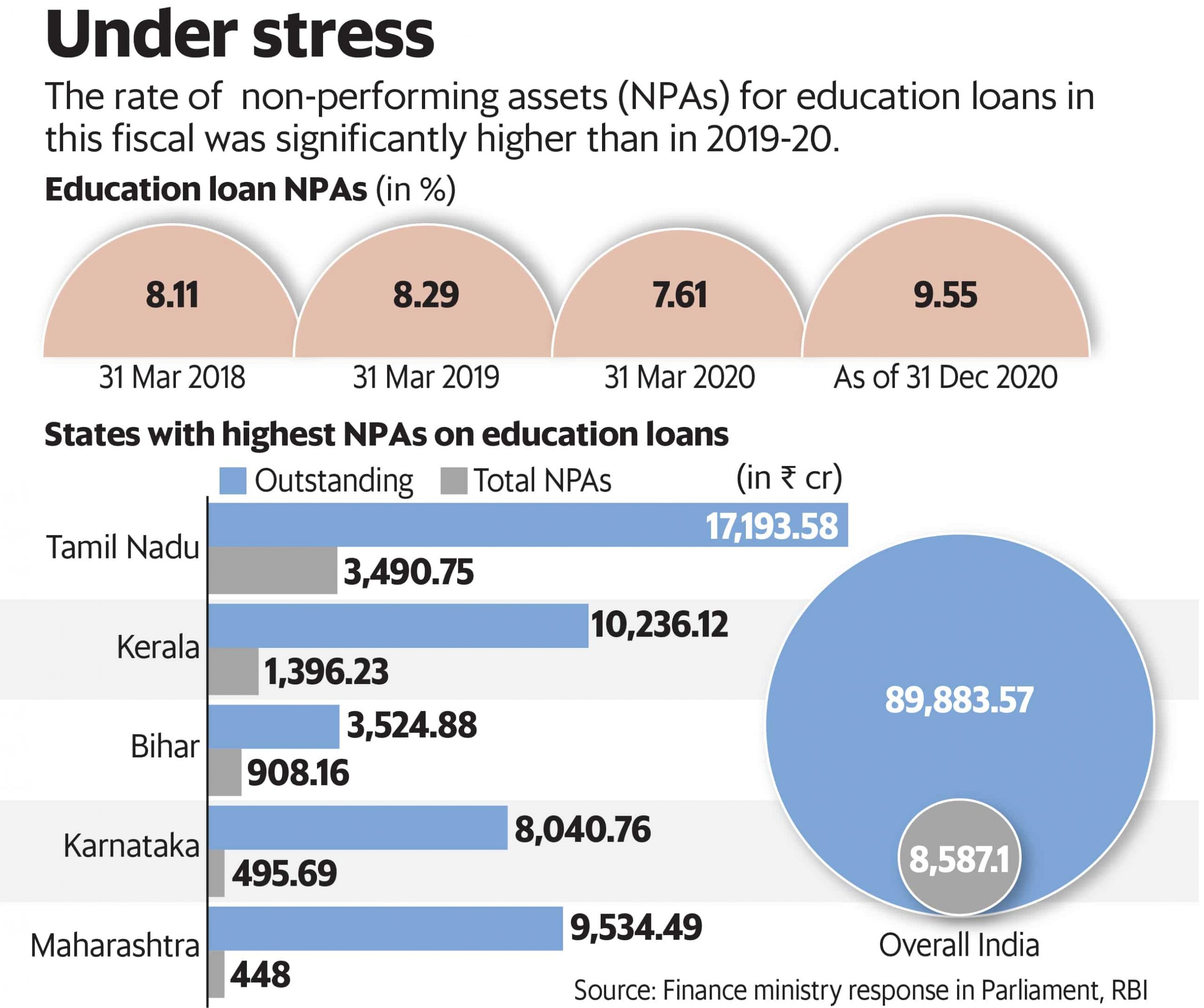

Banks reluctant to Sanction Education Loan as NPA level reaches to 10% approximately. Due to sharp increase in non-performing assets (NPA) in education loans is now a matter of great concern, as it could hamper the growth of bank credit for higher education in the country, according to an occasional paper published by RBI. Education costs have been on the rise in India. For instance, fees at the Indian Institute of Management, Ahmedabad, increased 43.6 per cent between 2016 and 2021. But banks have been reluctant to disburse more education loans to meet the increased costs. There are no government direction on restricting the Fees at such colleges or putting cap on maximum fees.

The jobs offered by these colleges are not as per the cost of the study and making the situation worst for the students.

The worst affected stream under Education Loan NPA is Engineering, which led the list of NPAs in the education sector with 176,256 accounts amounting to ?4,041.68 crore turning bad as on 31 December 2020, which is 2.2% in a year. Banks cannot take away an asset in the case of an education loan because in most cases there is no mortgage, unlike, say, a housing loan. The majority of the NPA is under this bracket only.

In India, around 90 per cent of education loans are disbursed by the PSBs. Private sector banks and regional rural banks (RRBs) accounted for around 7 per cent and 3 per cent of total education loan outstanding, respectively, as at end- March 2020, the paper published in June 2022 said. The outstanding education loans of all banks were Rs 79,056 crore at the end of March 2020 and at Rs 78,823 crore as of March 2021, as per the Report on Trend and Progress of Banking in India 2020-21 by the RBI. However, the outstanding loans increased to Rs 82,723 crore as of March 25, 2022. Also know – Canara Bank Abroad Education Loan, Eligibility & Apply Online

As per this model loan scheme, education loans of up to Rs 4 lakh do not require any collateral to be provided by the borrower, education loans up to Rs 7.5 lakh can be obtained with collateral in the form of suitable third-party guarantee, while education loans above Rs 7.5 lakh require tangible collateral. In all the above cases, co-obligation of parents is necessary. The second category of education loans are sanctioned to those students who obtain admissions to colleges/universities through management quota, provided they satisfy the minimum marks criteria in the preceding examination. Abroad education loan are safer loan for the banks, as there are security available. Get the best Abroad Education Loans without Collateral