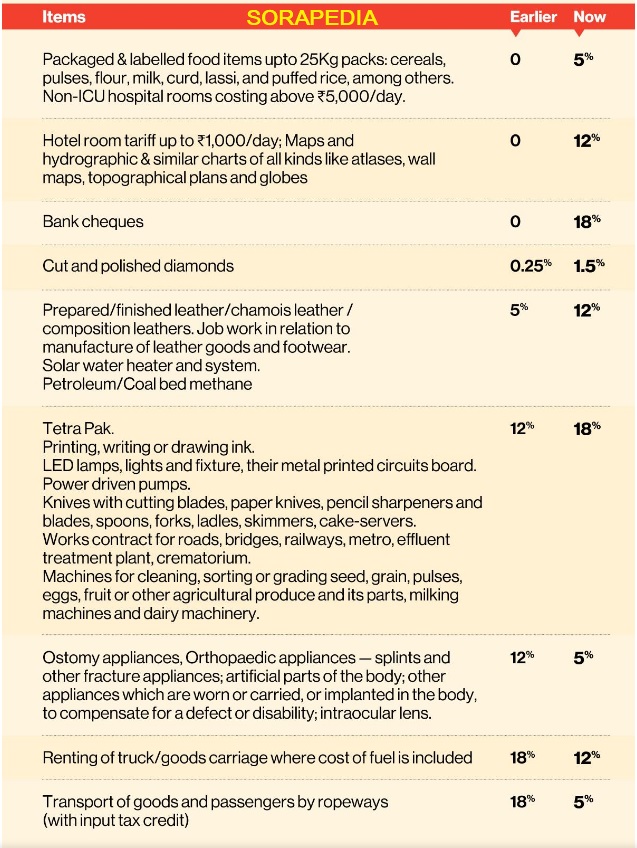

New GST Rates has been implemented by Government of India majorly for food items and banking services which are going to be costlier. Among the key items that have undergone rate change, packaged and labelled food items, weighing upto 25 Kg per pack or the retail packs, are set become costlier. While earlier, these goods were exempted from GST, now a 5 per cent tax will be applicable on them.

This shows that consumer staples like packaged wheat flour or atta, pulses (various types of dal, chana etc.), cereals like packaged rice will become dearer by up to 5 per cent from today. Similarly, milk, curd (dahi), lassi and puffed rice to attract 5 per cent GST.

Post Contents

What are Pre-packaged commodity ?

As per new GST rule, food items such as pulses, cereals like rice, wheat, flour etc, the supply of specified pre-packaged food articles would fall within the purview of the definition of ‘pre-packaged commodity’ under the Legal Metrology Act, 2009, if such pre-packaged and labelled packages contained a quantity up to 25 kilogram (or 25 litres).

Items Getting expensive?

- 18% GST will on fee charged by banks for the issuing cheques (loose or in book form).

- 12 per cent GST on hotel rooms below Rs 1,000 per day will be levied, as against a tax exemption currently.

- Maps and charts including atlases will attract a 12 per cent levy.

- GST on e-waste increased to 18 per cent from earlier rate of 5 per cent.

- LED lamps, inks, knives, blades, power-driven pumps and dairy machinery’s GST to be raised to 18 per cent from 12 per cent.

- Tax on miling machinery for cereals will be increased to 18 per cent from 5 per cent.

- GST on solar water heater, finished leather will be increased to 12 per cent.

- GST on specified goods for petroleum will be increased to 12 per cent from 5 per cent on input goods to correct inversion.

- GST on work contract services supplied to govt, local authorities will be 18 per cent. – GST on cut, polished diamonds increased from 0.25 per cent to 1.5 per cent.

- Transport of goods and passengers by ropeways to attract 18 per cent GST, up from 5 per cent (with ITC of services).

- Renting of truck/goods carriage where cost of fuel is included to attract per cent GST, up from 12 per cent. In case of Services, following exemptions are being rationalized: – Exemption on transport of passengers by air to and from NE states & Bagdogra is being restricted to economy class.

- Transportation by rail or a vessel of railway equipment and material.

- Storage or warehousing of commodities which attract tax (nuts, spices, copra, jaggery, cotton etc.)

- Fumigation in a warehouse of agricultural produce.

- Services by RBI,IRDA,SEBI,FSSAI, GSTN.

- Renting of residential dwelling to business entities (registered persons).

- Services provided by the cord blood banks by way of preservation of stem cells – Room rent (excluding ICU) exceeding Rs 5,000 per day per patient charged by a hospital shall be taxed to the extent of the amount charged for the room at 5 per cent, without ITC.

- Application fee charged for entrance or for issuance of eligibility certificate for admission or issuance of migration certificate by universities is exempt from GST.

- Due to ambiguity in GST rates on supply of ice cream by ice-cream parlours, GST charged at 5 per cent without ITC on the same during the period July 1, 2017 to October 5, 2021 shall be regularised to avoid unnecessary litigation.

- The GST on tetra pack too would be hiked to 18 per cent from 12 per cent at present.

Click for related business news.